Your camera falls down a mountainside or off a cliff. An unexpected rogue wave drenches your valuable photo gear in salt water. Your photo backpack is stolen from your home, motel room, or trunk of your car. To add insult to injury, you learn your homeowner’s insurance will not replace the value of your damaged or stolen gear.

Insurance Rider for Your Camera Gear or a Separate Policy?

Let’s deal with the last point first. Most homeowner’s insurance policies will not pay to replace the value of your lost, damaged, or stolen camera gear. Most policies have exclusions for expensive valuables like art work, jewelry, and camera gear. So unless you pay for a policy rider that specifically lists each valuable item you want insured, you are not going to get reimbursed for what the items are worth. Imagine losing several thousand dollars worth of camera gear and learning there is a $500 deductible and a maximum allowable value of $1000 so you only get $500 from the insurance company. If you haven’t already checked with your insurance agent to find out what your camera gear insurance limitations are, you should.

You have two choices. Add a rider to your homeowner’s (or renter’s) insurance policy, or get a separate policy to insure your gear. Either way you are going to need to make a list of the camera gear you want to insure. Send the list to your insurance agent for a rider quote, and to a separate insurance company to get a quote.

I personally do not recommend the home rider option unless you have a very small amount of relatively inexpensive camera gear. One of the problems with a rider on your home insurance policy is all of the limitations and exclusions. For example your gear is probably not protected against accidental damage when you are away from home, or theft from a vehicle unless there is damage to the car as evidence of a break in. So ask your insurance agent about all of the exclusions before you decide on a rider.

For a while I chose to add a camera gear rider to our homeowner’s insurance policy and then I got wiser after reading some informative photo magazine articles. I figured out I could get better coverage at less cost by getting a separate policy from a company that specializes in photo gear and photo business insurance. I do photo workshops, seminars, and photo safaris, and I am a paid portrait photographer, so I have business insurance in addition to camera gear insurance.

Should You Add Business Insurance?

If you just shoot landscapes, or if you shoot people for fun and are never paid for your people photography, the answer is probably no. If you do any kind of photography that involves pay and working with other people, even if it is just a fun sideline thing you only do a few times per year, you seriously need business insurance. If you are being paid to photograph people, all it takes to ruin you is for one litigious person to fall or get hurt during a photo shoot and sue you for everything you own. Liability and other kinds of business insurance (like errors and omissions) don’t add that much to your photo gear insurance policy.

An extra tip. As almost any Certified Financial Planner will tell you (even if you aren’t a photographer at all), you need a $1 million umbrella rider on your homeowner’s insurance,

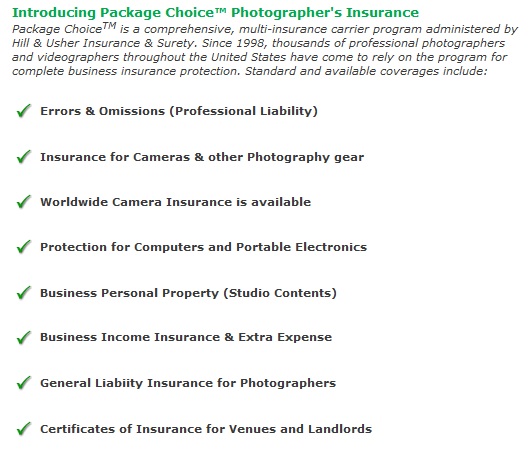

Package Choice from Hill and Usher

I HIGHLY recommend you look into “Package Choice” from Hill and Usher. Among professional photographers this is one of the most highly respected and trusted companies to deal with. They have been my photography insurance provider for years. One of the reasons they are so highly recommended is they do not exclude a lot of things other companies will exclude. Accidentally drop your camera in the ocean? They will pay for the replacement. Seriously, read this story. Which is another good thing, you get replacement cost, not depreciated value.

I HIGHLY recommend you look into “Package Choice” from Hill and Usher. Among professional photographers this is one of the most highly respected and trusted companies to deal with. They have been my photography insurance provider for years. One of the reasons they are so highly recommended is they do not exclude a lot of things other companies will exclude. Accidentally drop your camera in the ocean? They will pay for the replacement. Seriously, read this story. Which is another good thing, you get replacement cost, not depreciated value.

When you contact Hill and Usher (or any other company), let them know up front if you only want insurance coverage for your photo gear, or if you also want business insurance. They will work with you on all the options, even unusual options. When I started doing workshops in Rocky Mountain National Park, I soon learned the National Park Service (NPS) requires a $2 million certificate of liability insurance naming the NPS and Rocky Mountain National Park. Hill and Usher took care of it.

When you contact Hill and Usher (or any other company), let them know up front if you only want insurance coverage for your photo gear, or if you also want business insurance. They will work with you on all the options, even unusual options. When I started doing workshops in Rocky Mountain National Park, I soon learned the National Park Service (NPS) requires a $2 million certificate of liability insurance naming the NPS and Rocky Mountain National Park. Hill and Usher took care of it.

Package Choice from Hill and Usher is underwritten by The Hartford.

Photo Care and Photo Care Plus from PPA

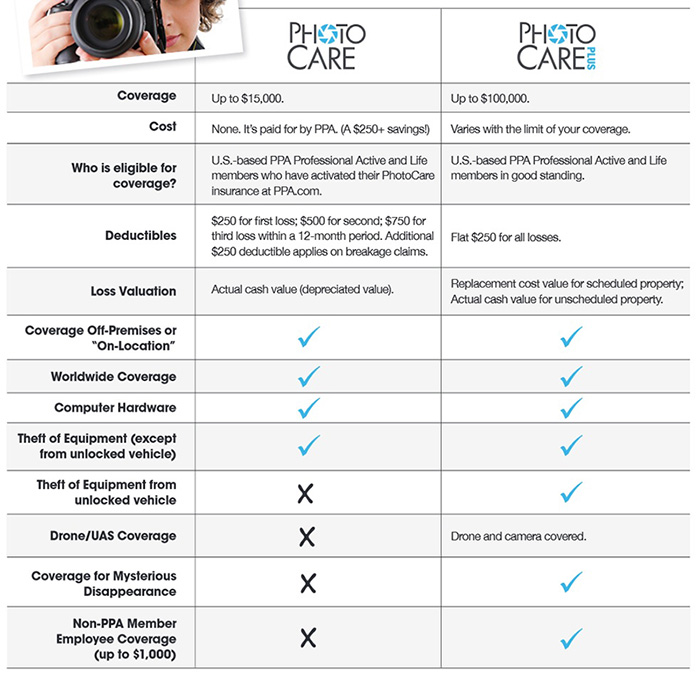

Another option is to join PPA, the Professional Photographer’s of America. Membership is $323 per year and includes up to $15,000 of “Photo Care” camera gear coverage with some exclusions. For more money you can get “Photo Care Plus” with less exclusions and insurance for up to $100,000 worth of gear.

The chart immediately above shows the differences. Photo Care Plus will cost you more (even if you have less than $15,000 worth of gear) but I think you need to pay the extra money to get rid of the exclusions on the left.

If your camera bag is stolen from your hotel room while you are out for dinner, that is a “mysterious disappearance” if there is no sign of forced entry. You can say it was probably hotel staff that did it, but if you can’t prove it you get no insurance money.

A photographer I met told me his car was stolen from his garage and his camera gear was stolen from his home. There was no sign of forced entry. That is a “mysterious disappearance”. If he had Photo Care from PPA he would not be paid a penny in insurance money for his stolen gear. If you go the PPA route you should consider paying extra for the Photo Care Plus. Photo Care Plus is a minimum of $175 per year. If you are doing the math, the $323 annual membership plus $175 for Photo Care Plus (for $5,000 or less of camera gear) is going to cost you a total of $498 per year.

As a side note, my friend probably had one one of those garage door safety release security problems you have probably read about where thieves can open your garage door from outside in just 20 seconds with only a coat hanger.

Photo Care Plus does not include business liability insurance. That is also extra (a minimum of $227.25 per year). If you are doing the math we are now up to a minimum of $625.25 per year for the membership, Photo Care Plus, and business insurance.

To figure out how much Photo Care Plus and liability insurance will actually cost you (over and above the $323 membership) based on the value of your gear and your business income, go to the calculators on this page. I plugged in my numbers and figured out PPA would cost me more than I am now paying at Hill and Usher and I get more and better coverage from Hill and Usher. So I would only recommend getting your insurance from PPA if you want to belong to PPA anyway.

Photo Care, Photo Care Plus, and PPA liability insurance is underwritten by Lockton Affinity.

Other Insurance Options

If you want to look at more options, read this article at PetalPixel. PPA and Hill and Usher are at the top of the list, plus there are 3 more companies.

Insurance Links

“Package Choice” from Hill and Usher

Article Links

THIS is Why You Need Insurance – Don’t Risk Your Livelihood – at FStoppers

Insurance For Photographers: Options and Tips For Protecting Your Gear – at SLR Lounge

5 Insurance Options for Protecting Your Business and Gear as a Photographer – at PetaPixel

Buyer’s Guide Series Link

This is one in a series of articles that will guide you to the best of all things photographic. The rest are here: Buyer’s Guide: Recommendations For The Best Photography Equipment, Software, Books, Magazines, DVDs, Online Photo Labs and More.